Jeni Browne, MFB, and Peter Littlewood, iHowz Landlord Association, discuss what the PRS needs from the upcoming general election and what this will mean for your mortgage.

Whether you want the general election or not, it brings about a mix of nervous uncertainty and opportunity for change. In this article, we look at how the election could impact two significant issues that impact all landlords: legislation and mortgage interest rates.

Experts in their fields, Jeni Browne and Peter Littlewood, discuss:

- How legislation in the PRS has changed over the years

- What legislation the PRS needs from this election

- How the election cycle could impact mortgage interest rates

- What you can do to ensure you secure the best finance

What the Rental Market Needs from the Upcoming General Election

Peter Littlewood, Co-Founder of iHowz Landlord Association, has campaigned for fairer private rental sector (PRS) legislation for decades. Drawing on his experience, he explains what he and iHowz hope to see from the party manifestos in this year’s election.

A general election can only mean one thing: a new Government and, almost certainly, a new Housing Minister. Each incoming Housing Minister is keen to leave their mark, but as a landlord association, we urge the following:

- Continuity: The role of Housing Minister should have stability, ideally remaining unchanged for the duration of the Parliament. Since 2010, there have been 16 Housing Ministers, a turnover rate that undermines the position's importance.

- Housing Knowledge: While expertise in housing for a new minister is beneficial, it is secondary to the need for continuity.

- Pragmatic Changes: Despite the last significant overhaul of the Private Rented Sector (PRS) occurring in 1988, with a notable Act in 2004, we implore that the new minister avoids unnecessary changes driven by personal ambition, or political rhetoric. Currently, landlords navigate over 170 pieces of legislation, and many Local Authorities lack the resources to enforce them adequately.

Historically, the balance of power in the PRS has swung dramatically. Before 1977, landlords held substantial power, leading to unfair practices. Between 1977 and 1985, tenant protections were so strong that the number of rental properties dwindled. The 1985/88 Housing Acts struck a balance that has allowed the PRS to thrive. Contrary to some claims, the current laws provide significant tenant protections.

It is true that the market has changed substantially since 1985, and some legislative updates are necessary, particularly to address ambiguous language in older laws. But future legislation should rest on three principles:

- PRS housing is the tenants’ home.

- PRS is a business for landlords, crucial for their livelihood.

- Legislation must be fair, proportionate, and explicit.

Successive Governments have made the situation worse by not building enough houses in general, and specifically affordable/social/council housing; then complain when private landlords step up to fill the shortfall – at the private landlords' expense and risk.

iHowz proposes a comprehensive review of the PRS rather than superficial tweaks and has published their manifesto calling for a set of clear-cut amendments to create a fairer, more efficient PRS that benefits both landlords and tenants, fostering a stable and well-regulated housing market.

Their manifesto, The New Tenant-Landlord Partnership can be seen on their website at iHowz.uk/manifesto.

What the General Election Means for Your Mortgage

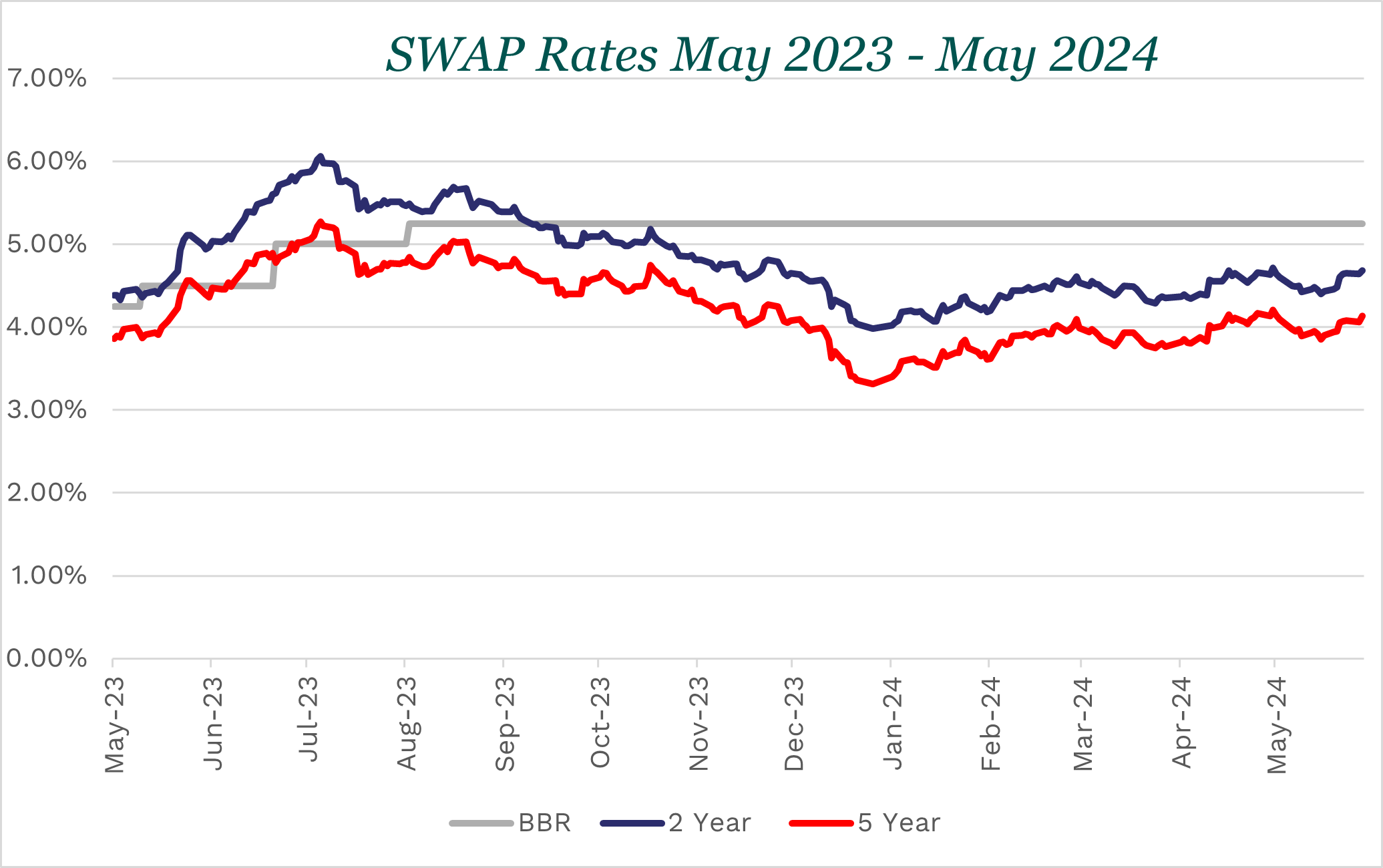

Since January, SWAP rates (the rates which influence mortgage interest pricing for many lenders) have moved up and down almost daily. Although less volatile than this time last year, knowledge of the upcoming general election, US inflation, and geopolitical events means that the market has not been as steady as we’d hoped.

As we get further into this election period, we‘ve already seen a knock-on impact on SWAP rates. The announcement of a general election received a negative reaction from the money markets, with SWAP rates rising slightly over the last two weeks.

The current political landscape means the UK economy is in a period of instability. The money markets eagerly await each Party’s manifestos to see what measures they could introduce and what inflationary impacts these could have. Until then, we don’t anticipate any significant SWAP rate rises, meaning mortgage interest rates should remain mostly stable. Of course, other factors mentioned above could still have some influence, but we don’t expect a return to the volatility we saw this time last year.

We did expect a Bank of England Base Rate (BBR) decrease in June; however, it’s the convention (although not the rule) to keep the BBR at its current level throughout a general election period. Experts still predict the first 0.25% drop this summer, but August may be more realistic than June, with mid-September another plausible option if the economy is still settling in the wake of the election.

How you can prepare

Mortgage lenders will continue to adjust pricing (up and down) during the election period, meaning many investors will continue to delay refinancing until there is a clearer decrease in pricing. While this is up to you, we strongly recommend taking stock of your property portfolio and discussing your plans and finances with us to ensure you’re making fully informed decisions.

For those considering their next property investment purchase, it’s worth noting that UK house prices rose 0.4% month-on-month in May, with annual growth rate up to 1.3% from 0.6% in April, according to Nationwide. With house prices starting to show signs of bouncing back, time is running out to take advantage of cheaper housing stock!

To keep up-to-date with how any new legislation changes will impact your property investment business and get access to experts and support, join the iHowz Landlord Association. As an MFB client, you can claim your first year’s membership for FREE! For more information about the benefits of joining, click here.