The UK Money Markets

Your guide to the latest money market changes

The latest UK money market updates

Bank of England Bank Rate: 3.75%

UK 1 month SONIA: 3.8636% - 0.0043%

UK 3 month SONIA: 3.9493% - 0.0038%

SONIA figures provided by chathamfinancial.com are rounded to four decimal places. (Please note these figures are behind and, therefore, correct as of 09/01/2026)

|

Year(s) |

Current Rate |

Last Published Date / Rate or Change |

|

1 |

3.48% |

0.00% |

|

2 |

3.41% |

-0.01% |

|

3 |

3.45% |

0.00% |

|

5 |

3.56% |

-0.01% |

|

7 |

3.69% |

-0.01% |

|

10 |

3.89% |

-0.01% |

(SWAP rates provided by chathamfinancial.com, rounded to two decimal place)

Getting started with

buy to let mortgages

What is the Bank of England Base Rate?

From March 2009, the Base Rate was held at 0.5% until August 2016, when it was reduced to 0.25%. It returned to 0.5% in November 2017 and rose again to 0.75% in August 2018. When the pandemic struck in March 2020, the Bank of England rapidly cut the Base Rate, first to 0.25% on 11 March and then to a historic low of 0.1% the following week. The first increase since 2018 occurred in December 2021, as the rate was raised from 0.1% to 0.25%. Over the next two years, the Base Rate climbed significantly, peaking at 5.25% by late 2023.

Following a sustained easing of inflation, the MPC delivered its first rate cut in more than four years in August 2024, marking the beginning of a gradual downward cycle. By December 2025, the Bank Rate had been reduced a total of four times during the year, bringing it down from 4% to 3.75%, its lowest level in nearly three years.

Experts now anticipate a continued but cautious path of reductions through 2026 as inflation moves closer to the 2% target, though the MPC has signalled that future cuts will depend closely on incoming economic data.

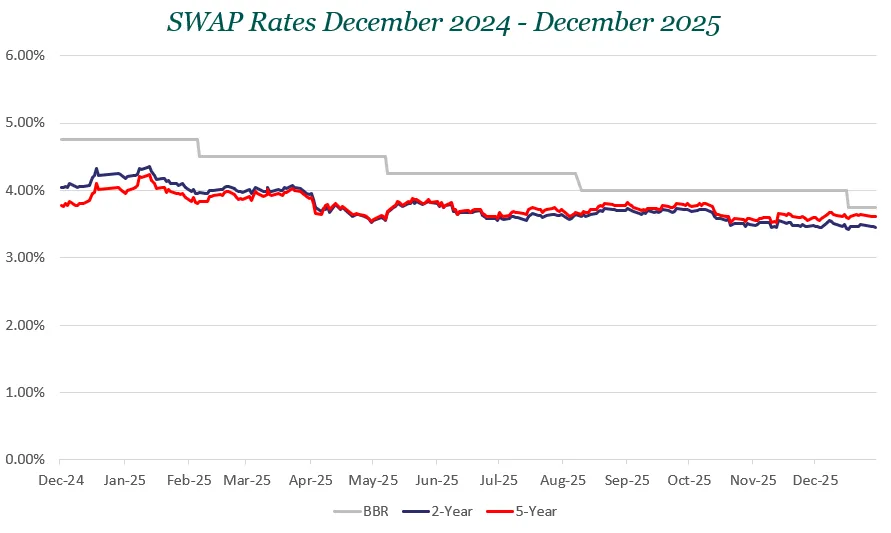

What are SWAP rates?

SWAP rates are the rates at which lenders buy fixed-term funding from other financial institutions. Similar to how you borrow a mortgage with a fixed interest rate, lenders borrow money at a fixed rate for 2, 3, 5, or 10 years. This is known as the SWAP rate.

The SWAP rate price becomes the benchmark for pricing your fixed-rate mortgage. Your lender then adds a margin to ensure they profit from your loan. So, when SWAP rates go up, fixed mortgage rates usually rise too. When SWAP rates fall, lenders can offer lower fixed rates.

What is SONIA?

The Sterling Overnight Index Average, or SONIA, reflects the average interest rate that banks will pay to borrow sterling overnight from other banks, building societies and financial institutions. These institutions will use SONIA in many different ways, but primarily to calculate the affordability of their transactions.

Top Five FAQs for Starting Your Property Investment Journey

As a first-time landlord, starting your property investment journey can be daunting. Below, we answer the top FAQs we hear from aspiring property investors.

Talk to an expert

Have all the facts and figures you need to purchase or remortgage your property? Our experts will make the whole process easier for you! Give us a call or choose a convenient time for us to call you. Drop us an email or chat with a human on our live chat.

Meet your mortgage makers

Let's talk mortgages

Buy to Let

Mortgages

Need a mortgage for a property let out to tenants? You’ve come to the right place.

Homebuyer

Mortgages

Buying your dream home or remortgaging your property? We've got you covered

Commercial

Property

Letting out a commercial property or buying one for your business? We can help.

Short-Term

Finance

Looking for fast finance with flexibility? Discover how short-term finance can help.

Don’t miss a thing with our exclusive investor newsletter

Receive the latest mortgage industry news, property investment tips, inspirational case studies and exclusive mortgage rates, straight to your inbox! Sign up for our newsletter; it’s free!