New reports show that buy to let remains a strong investment type. From increased mortgage approvals to the new landlord, here’s how buy to let is changing for the better.

For years, landlords have navigated the ever-changing buy to let market. This year alone, we saw the most significant change to the sector since its inception with the Renter’s Rights Act becoming law.

Despite tough legislation, money market fluctuations, and government sentiment, landlords have remained resilient, and the data shows that you are pushing forward.

Here, we examine how the market has performed this year and the positive ways in which the sector is evolving.

Mortgage Data Reflects Uptick in Activity

According to UK Finance, over 58,000 new buy to let mortgages were approved in Q1 2025, up nearly 40% on 2024. This dipped slightly in Q2 to 49,590, down just 2.6% year-on-year.

What’s more, landlords seem keen to continue to find new investments, with loans for new purchases accounting for 25% of new buy to let lending.

Limited Companies Continue Popularity Streak

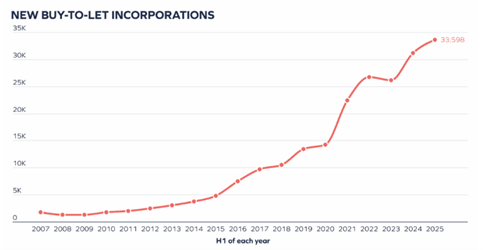

Landlords aren’t just purchasing property; they’re thinking strategically about how they invest. A record 33,598 buy to let companies were set up in the first half of 2025. The Stamp Duty increase from April failed to deter investors, with the number of new Limited Companies getting set up continuing to rise throughout May and June.

Source: Companies House & Hamptons

The move to Limited Company incorporation reflects landlords’ future-proofing their investments. Limited Company investment is a great way for landlords to keep their portfolios cost-effective and tax-efficient.

Watch our FREE webinar ‘BTL Incorporation & Landlord Tax’ here.

Average Rental Yields Remain Positive

Landlords are also earning more from their rental properties, with Fleet Mortgages reporting average rental yields of 7.5% across England and Wales in Q3 this year, an increase from 7.2% year-on-year.

Regionally, the North East boasts the highest average rental yields at 9%, with the North West following closely behind with 8.5%. Greater London recorded the lowest yield at 5.9%, with no change year-on-year.

A New Generation of Landlords

Hamptons’ analysis of Companies House data shows that millennials (individuals born between 1981 and 1996) now account for roughly half of all shareholders in buy to let Limited Companies set up in 2025. This figure is more than double that recorded just five years ago.

Consequently, Hamptons expects that by the end of this year, millennial investors will have founded more than 33,000 new buy to let companies.

Is buy to let stronger than ever?

The reports and new data show that landlords are not disincentivised from buy to let; in fact, they’re far from it.

As new purchase loans rise and Limited Company investment continues to support property investors, existing and new, the sector shows clear signs of optimism.

This positive sentiment does not eradicate the challenges that will undoubtedly come from the Renter’s Rights Act. It reflects landlords' determination to navigate the changes, but to do so, support from industry professionals will be invaluable.

Having the right guidance as you continue with your property investment journey is essential. We’ll help you secure competitive rates to boost your profits and navigate the changes from the Renter’s Rights Act to help you feel confident in your property finance plans.

Speak to an expert

If you want to discuss your mortgage plans ahead of the budget, our team of experts are here to help.

Call us on 0345 345 6788 or submit an enquiry here.

>> Visit our Renter’s Rights Act hub for more information on the changes to the PRS