When it comes to buying or selling property at auction, understanding the difference between traditional and modern methods is key. Each offers distinct advantages depending on your goals, timeline, and financing options.

Here, we cover:

- The differences between traditional and modern auctions

- Which properties suit each method

- What happens if you can’t complete on time

What Is a Traditional Auction?

The traditional auction is what most people picture when they think of property auctions, like Homes Under the Hammer. It’s an unconditional sale, meaning the highest bidder on the day enters into a legally binding contract with the vendor the moment the hammer falls.

Here’s how it works:

- The buyer pays a 10% deposit immediately

- Completion typically happens within 28 days

- If the buyer pulls out, they forfeit their deposit

What’s more, if the vendor resells the property for less at a later date, they can pursue the original buyer for the difference in small claims court.

This method is fast and secure, but it does limit some buyers, especially those relying on traditional mortgages. Around 70% of buyers in traditional auctions are cash buyers, often purchasing properties that need work or aren’t mortgageable. However, if you don’t have the cash available, you can always consider a short-term loan like auction finance.

What Is the ‘Modern’ Method of Auction?

The modern method is a conditional sale platform, a more flexible approach that’s gaining traction. It’s designed to appeal to a wider range of buyers, particularly those using mortgage finance instead of cash or short-term finance to purchase the property.

Here’s how it differs:

- The buyer pays a reservation fee (typically 1% of the purchase price)

- They get 56 days to exchange and complete

- The reservation fee is a financial commitment, but not legally binding

- If the buyer doesn’t complete, they lose the reservation fee, but aren’t liable for further costs

This method is ideal for well-presented homes and mortgage buyers. It’s a halfway house between auction and private treaty (the traditional estate agent-led way of buying property), offering the competitive bidding environment of an auction with the flexibility of traditional financing.

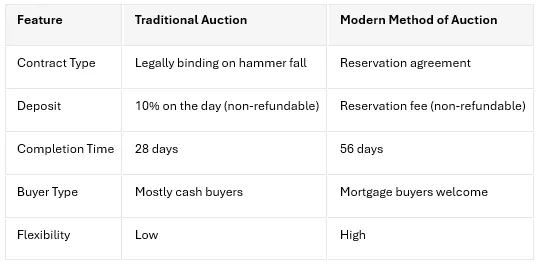

The Key Differences

Which Properties Suit Each Method?

Traditional auctions are typically best suited for properties in poor condition, potentially with structural issues. These typically require cash buyers or a short-term property loan due to their un-mortgageable status. These might include investment opportunities, plots of land, or more unusual listings such as dry dock boats or even nuclear bunkers!

In contrast, modern auctions can be better suited to mortgageable properties, like well-presented family homes, upsizing or downsizing opportunities, and residential stock that’s ready to move into. However, more ‘quirky’ properties can still be purchased at modern auctions.

For those relying on mortgage finance, this new method offers a more flexible route to sale while still benefiting from competitive bidding.

What Happens If You Can’t Complete on Time?

In either method, open communication is key. Vendors are often willing to offer short extensions if you're running late on completion, especially if you’re transparent about the reasons. It’s at the vendor’s discretion, but most would prefer to accommodate a committed buyer than re-list the property.

Final Thoughts

Both traditional and modern auctions have advantages depending on the financing plans and the type of property you're dealing with. Traditional auctions are ideal for buyers who are ready to move quickly and are comfortable with the certainty and speed of these unconditional sales.

On the other hand, modern auctions provide more flexibility, making them well-suited to mortgage buyers and those looking for a slightly longer timeframe to complete.

As the auction market changes, both methods are becoming more accessible and better understood.

Read our Step-by-Step Guide to Buying Auction >>

Next steps

Planning an auction purchase? Speak to our experts and get the finance right first time! Call us on 0345 345 6788 or submit an enquiry here.