Is property still a worthwhile investment? Below, we look at why you should consider becoming a landlord, particularly in the current market.

Over the last few years, media coverage of the PRS has been steadfast in its anti-landlord rhetoric. Combined with tougher legislation and ongoing mortgage rate pricing changes, it’s no surprise that many potential property investors are on the fence about becoming landlords. So, is it still worth being a landlord? Below, we discuss why you should invest and how to ensure your plans are successful.

Is being a landlord easy?

Despite what you may be led to believe, becoming a landlord is not a ‘get rich quick’ scheme. It’s a long-term investment that requires an understanding of how the property market works and a level of resilience to weather the storms as they come.

There can also be a lot of work that comes with your property portfolio. The admin of your mortgage applications, tenancy documents, and day-to-day management of your properties can add up, particularly if you own several investments. Many landlords work with letting agencies to help them handle this extra workload. Consequently, your rental income is by no means ‘passive’. It’s important to consider all the responsibilities of being a property investor when deciding whether it’s right for you.

Is it still worth it?

As mentioned, many challenges have shaped the property market over the last few years: the economic fallout from Liz Truss’ mini-budget, the ongoing threat of abolishing Section 21 evictions, and fourteen consecutive Base Rate rises, to name a few. However, landlords continue to reap the rewards from their property investments.

Rising rents

Average rents continue to rise year-on-year, helping landlords maintain profitability amidst economic volatility. Zoopla’s latest rental market report showed rents have increased by 6.6% in the year to April 2024, with regions such as Newcastle and Edinburgh showing fantastic annual rental growth of 10% and 9.1%, respectively.

Furthermore, if you exclude London’s micro-market from the overall UK market, rental growth across the UK is more positive, at 8% year-on-year. The pace of rental growth is starting to slow, as is necessary for rental properties to remain affordable for tenants. Still, this latest data should reassure landlords of the stability of the returns from their investments.

Property agencies such as Rightmove and Zoopla publish quarterly reports highlighting regional performance, helping you better determine where to focus your investments.

Tenant demand

As first-time buyers continue to struggle to raise deposits or secure affordable mortgages, the rental market is under pressure to provide alternative housing. The supply and demand disparity has taken control of the PRS over the past few years and is one of the main reasons rents have risen to the extent they have.

However, we are starting to see demand ease. Rental demand is down 25% over the last 12 months, but according to Zoopla, 15 households are still chasing each rental home. This remains over double the pre-pandemic demand levels, with just six applicants per property on average between 2017 and 2020.

Top-performing property types

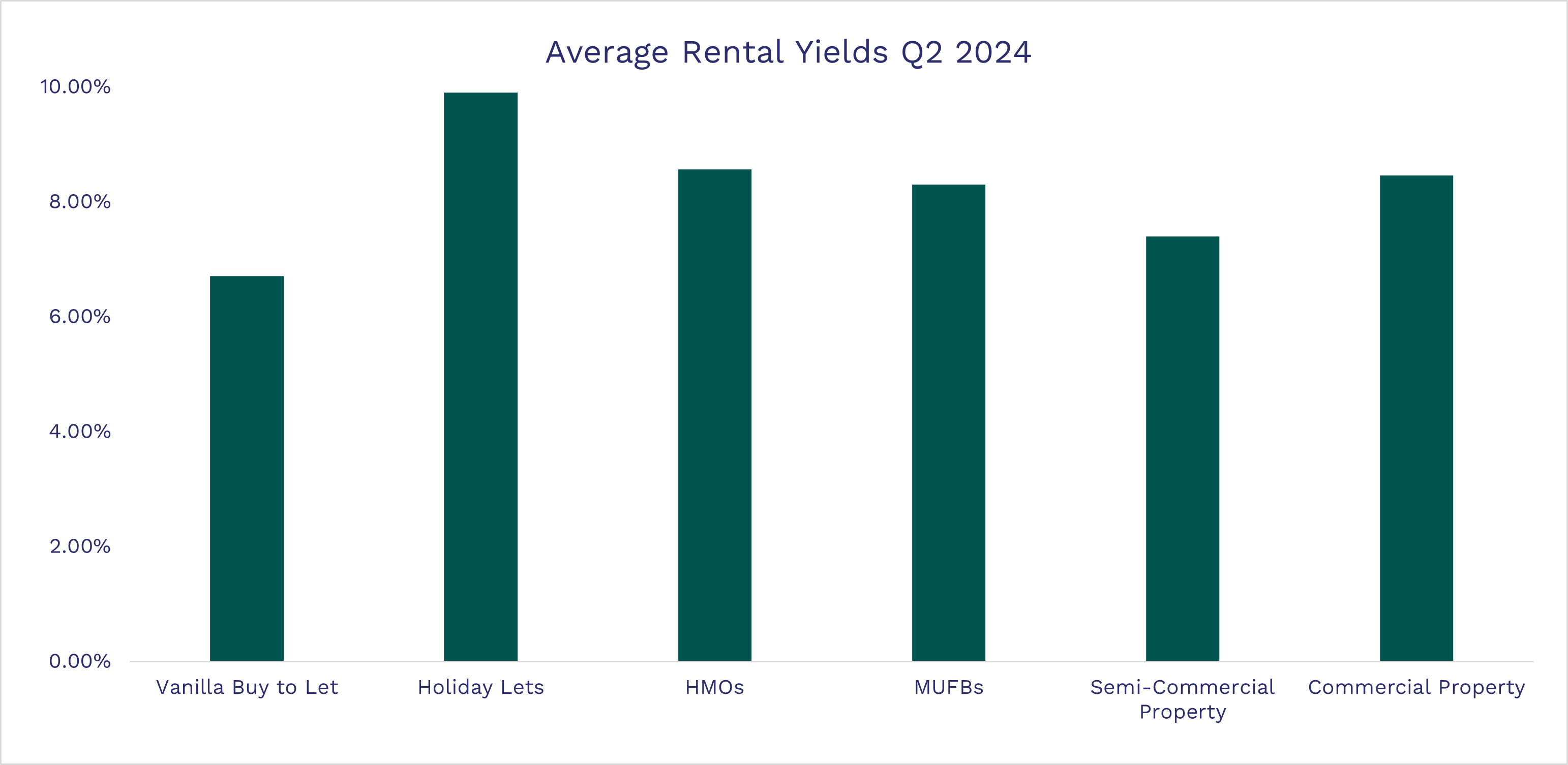

Focusing on more complex property types has never been more important for landlords looking to boost the returns on their investments. Properties such as HMOs, Multi-Unit Freehold Blocks, and even Holiday Lets continue to outperform ‘vanilla’ buy to lets in rental yields.

It’s worth noting that if you are a first-time landlord, you will need some experience before most lenders accept you for properties such as HMOs and MUFBs. However, we do have access to some lenders who will accept applications from first-time landlords – get in touch with our mortgage experts to learn more.

How to successfully start your property investment journey

Starting on your property investment journey can be daunting, particularly given the perception of the current market. Our top piece of advice for a successful start is to do your research to ensure you’re making well-informed property investment decisions.

Our blog, which answers the top FAQs we hear from landlords taking their first steps on the property ladder, is a great place to start. Furthermore, our expert brokers are always happy to answer any questions you might have about the property market.

To get in touch, call our experts on 0345 345 6788 or submit an enquiry here.