How is the buy to let market performing so far in 2025? A new report reveals that rental yields continue to rise across most regions and that many landlords are looking to expand their property portfolios.

The Q2 2025 Rental Barometer from Fleet Mortgages reflects the resilience within the buy to let market. Despite regional fluctuations, rental yields remain strong and rents are rising in key areas. Most importantly, the report reveals that landlords are confident in expanding their portfolios. Here, we break down the key takeaways of the latest insights.

Rental Yields: Stability with Regional Strength

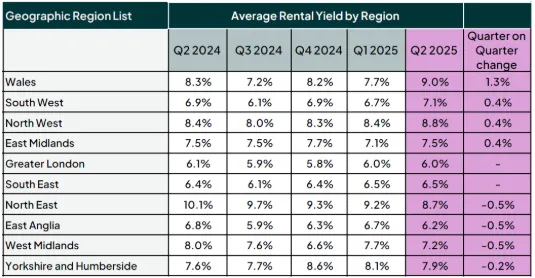

Average rental yields across England and Wales held steady at 7.5% in Q2 2025, up slightly from 7.4% in Q1. This marginal increase reflects a stabilising market, with several regions continuing to offer compelling returns:

- Wales performed the strongest in Q2 with a 9% average yield, up 1.3% quarter-on-quarter

- The North West follows at 8.8% and the North East at 8.7%, despite a slight annual dip

- Greater London has the lowest average rental yield, at 6.0%, reflecting higher property prices

While four regions (the North East, West Midlands, East Anglia, and Greater London) saw annual yield declines, the overall picture remains positive. Fleet Mortgages suggests this is down to ongoing tenant demand, easing mortgage rates, and a more generous affordability landscape.

Source: Fleet Mortgages

Rents by Region: Demand Drives Growth

Average rents increased by 2.9% across all Fleet lending areas quarter-on-quarter. The highest regional shifts included:

- The North East with a staggering 21.8% increase, with average rents jumping to £900 per month from £739 in Q1 of this year

- Wales followed with a 7.8% rise to £1,061 per month from £984

- Greater London rents climbed 6.5% to £2,328 per month, maintaining its position as the most expensive region

However, not all regions experienced growth. The West Midlands saw the steepest decline at -5.8%, followed by the South East (-3.5%), South West (-1.6%), and Yorkshire & Humberside (-1%).

Market Indicators: Easing Rates and Portfolio Confidence

The report also highlights several key indicators that point to a competitive, yet cautiously optimistic, market:

- The Bank of England Base Rate (BBR) dropped from 4.5% to 4.25% in May, which shows confidence from the Money Markets

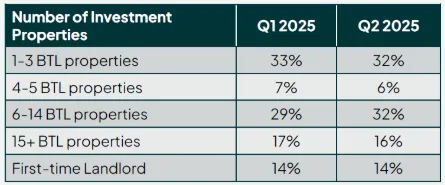

- Purchase activity held steady at 39%, with 54% of landlords owning four or more properties.

- Limited Companies continue to be the preferred property investment type, accounting for 81% of all applications.

- First-time landlord activity remains consistent at 14%, indicating ongoing interest in entering the buy to let market.

- The average loan size decreased slightly to £198,000, suggesting landlords are managing affordability carefully.

Source: Fleet Mortgages

Opportunity in the buy to let space

Fleet’s Q2 2025 Rental Barometer shows a market that’s holding its ground despite wider economic shifts. Yields are steady, rents are climbing in key areas, and borrowing costs are starting to ease, so it’s no surprise that landlords, both experienced and new to the game, are still actively investing.

That said, regional differences really matter. It’s worth weighing up both the immediate rental returns and the longer-term growth potential when deciding where to grow your portfolio.

Speak to an expert

To discuss your property investment plans, speak to our experts on 0345 345 6788 or submit an enquiry here.